TL;DR

We match our go-to-market strategy to four key factors: price, complexity, time-to-value, and buyer type.

Each product line sticks to one primary motion.

Product-led growth (PLG) works best when users can try our product, succeed quickly, and share it. Sales-led approaches shine when buying committees, higher risk, and tricky integrations come into play.

Hybrid models blend both, with smooth handoffs between teams.

We set clear PQL/MQL criteria and routing rules. Compensation matches a single funnel approach.

The Motion Fit Score and payback calculations guide us in picking the right strategy and knowing when to switch.

We set up guardrails for privacy, accessibility, and avoid manipulative growth tactics from the start.

Key definitions (one line each)

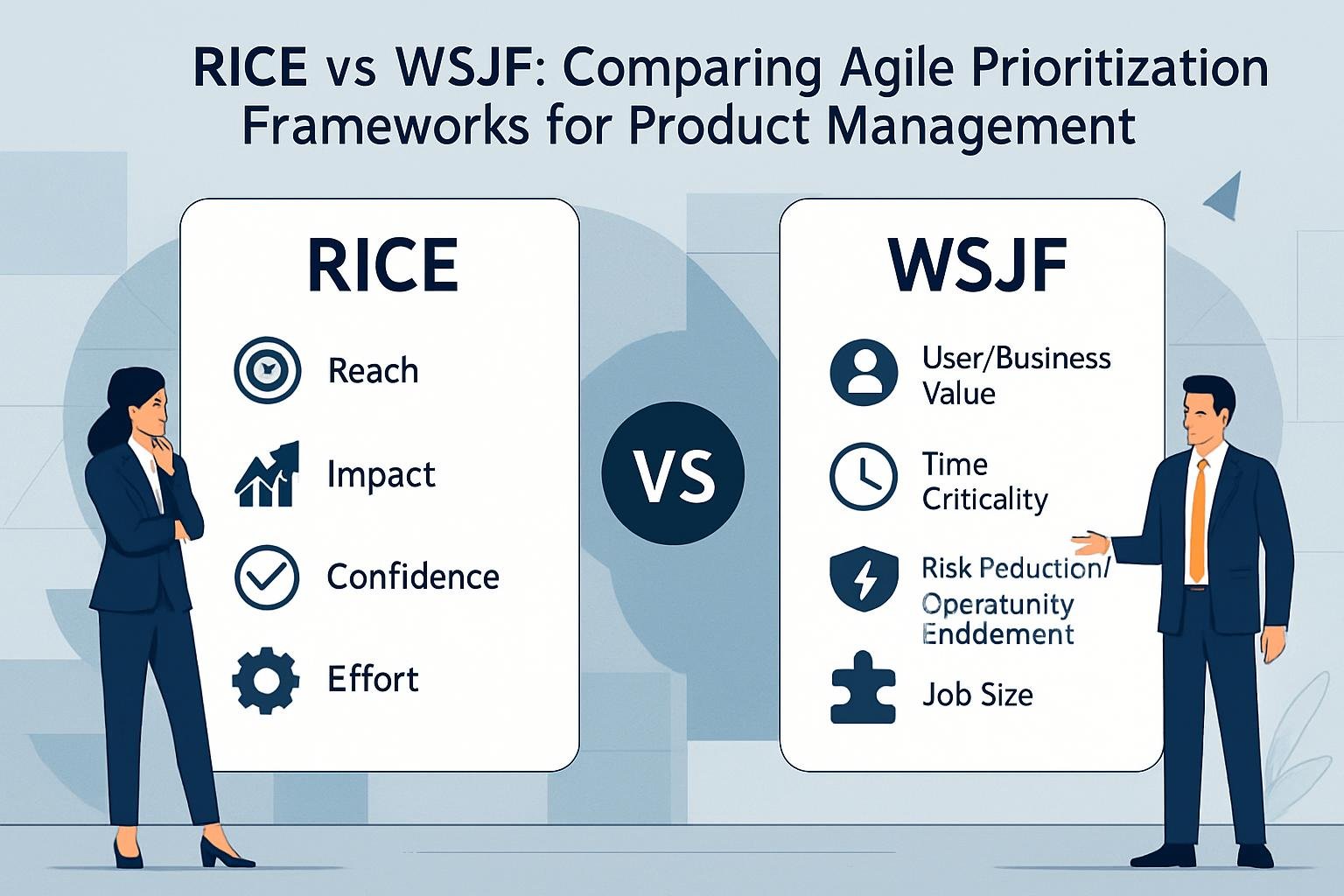

PLG (product-led growth): Users try the product on their own—usually through trials or free versions—and the product itself drives demand.

Sales-led: Sales reps qualify leads, demo the product, and handle negotiations through meetings and traditional sales processes.

Hybrid: Customers start with self-service options. Later, sales teams help expand and standardize accounts with clear handoff points.

PQL (product-qualified lead): A user or account that hits certain success points in the product, signaling they’re ready to buy.

MQL (marketing-qualified lead): A contact who shows interest through things like filling out forms, attending events, or checking out content.

North Star metric: The main outcome that guides your go-to-market plans—like weekly active workspaces.

Payback period: The months it takes to earn back customer acquisition costs from profits.

Rule of thumb (sanity check)

Deal size is a quick gut check for our acquisition approach.

PLG works best when average contract value is under $5-20k. Users can try the product solo and see value fast.

Sales-led makes sense when deals reach $20-50k or more. Bigger purchases need approvals and security reviews.

Hybrid approach fits when teams start small but need help for company-wide rollouts.

Quick diagnostic: the Motion Fit Score (15 minutes)

The Motion Fit Score helps us figure out the best customer acquisition approach for our product.

We rate five factors from 1 to 5 and multiply each by its weight.

| Factor | Weight | 1 (PLG) | 3 | 5 (Sales-led) |

|---|---|---|---|---|

| ACV / price | 0.30 | <$5k | $10–25k | >$50k |

| Time-to-value | 0.20 | <1 day | 1–7 days | >30 days |

| Integrations / risk | 0.20 | None | Few | Many/regulated |

| Buyer shape | 0.20 | Solo/team lead | Director | Committee/CIO |

| Virality / network | 0.10 | High | Medium | Low |

After scoring, we add up the weighted results. The total tells us which marketing funnel fits best.

Score meanings:

- ≤ 2.5 → PLG primary

- 2.6–3.4 → Hybrid

- ≥ 3.5 → Sales-led

Step-by-step playbook

1) Choose one primary motion (and name the secondary)

We start with a clear one-liner, like “For Product X, product-led growth primary, sales assists for deals over $25k.”

This statement shapes our whole go-to-market plan.

Next, we publish a RACI matrix. It shows who’s responsible, accountable, consulted, and informed at each stage.

We map this for demand gen, customer activation, expansion, and renewals. Sales and marketing both know their lanes.

The primary motion drives most customer acquisition. The secondary motion picks up the edge cases and bigger deals.

2) Design the offer for the motion

For product-led growth, we pick between freemium or free trial models. Freemium is ongoing; free trials are time-limited.

Either way, we aim for first value in under an hour. Fast wins help us reach product-market fit sooner.

For sales-led, we prep business-case demos, proof of value sessions, security packages, and reference stories. These help our target customers get our value proposition.

Hybrid approaches let users self-serve to team value. Then, enterprise plans add SSO, audit controls, and volume pricing strategy options.

3) Instrument the funnel

We set clear product qualified leads. For example: workspaces with three or more active users and two key actions per week for two weeks.

These metrics help us spot serious prospects from our target audience.

Our routing system matters. Named-account leads go to sales development reps within an hour. Other leads stay in product-led nurture flows.

This keeps our customer acquisition cost in check and boosts conversions.

We set service level objectives for response times. Sales development reps, account execs, and customer success managers all have targets.

In-app sales-assist chat gets its own response standards.

4) Price and package coherently

Product-led pricing stays transparent. Users upgrade in-app, usually via usage-based or per-seat models.

This supports the freemium model and keeps conversion rates healthy.

Sales-led deals look different. We do multi-year contracts, volume discounts, and professional services. Legal terms get more complex for enterprise buyers.

Hybrid models use one price meter for both motions. Enterprise add-ons bring admin controls, security, and data governance. This serves our whole ideal customer profile range.

5) Run motion-specific experiments

Product-led tests focus on user experience. We play with onboarding checklists, paywall placement, trial length, templates, and viral loops.

Each experiment aims to boost our customer experience.

Sales-led experiments target the human side. We test talk tracks, proof of value scope, and ROI calculators. Mutual action plans help move deals quicker.

Hybrid tests bridge both. We tweak product qualified lead thresholds and sales rep timing. In-app “Talk to Sales” prompts get regular updates too.

6) Govern the motion stack

We keep one forecast and pipeline for all motions. Shared stage definitions avoid confusion.

This unified view helps us track progress toward business objectives.

Comp plans line up with our chosen motion. Sales-assist teams get paid on expansion, not just free-to-paid conversions. This stops internal competition with product-led growth.

We review motion performance every quarter. Motion Fit Scores, PQLs, and routing triggers get a refresh.

7) Write the switch criteria now

We switch to sales-led when deal values climb, integrations get messy, or procurement slows us down. Those are signs buyers want more human touch.

We tilt toward product-led when activation speeds up. If self-serve expansion beats assisted expansion, we lean more PLG. Fast user wins drive that call.

We document every strategy change. Each gets a one-pager with a 90-day migration plan. This keeps marketing strategy and sales strategy in sync during changes.

Trade-offs at a glance

| Motion | Pros | Cons | Use when |

|---|---|---|---|

| PLG | Low customer acquisition costs; fast user feedback; viral growth potential | Enterprise sales challenges; slow procurement processes | Low contract values, quick time-to-value, user-driven decisions |

| Sales-led | Manages complex deals and custom terms | Higher customer acquisition costs; slower feedback cycles | High contract values, integrations needed, buying committees |

| Hybrid | Land and expand opportunities; adaptable approach | Coordination challenges and compensation complexity | Teams self-serve while organizations need standardization |

Worked example: payback math (sanity check)

Formula: Payback (months) = CAC ÷ (ARPA × Gross Margin − Cost-to-Serve)

Let’s run through a couple of scenarios and see if the numbers make sense.

PLG scenario: CAC $60; ARPA $100/mo; GM 80%; CTS $10

- Contribution = 100×0.8 − 10 = $70

- Payback = 60 ÷ 70 = 0.86 months — that’s pretty quick, so PLG looks solid here.

Sales-led scenario: CAC $5,000; ARPA $800/mo; GM 85%; CTS $80

- Contribution = 800×0.85 − 80 = $600

- Payback = 5,000 ÷ 600 ≈ 8.3 months — not bad for enterprise, but you’d better have good retention or some upsell in your back pocket.

Guardrails: PLG usually aims for under 3 months. Sales-led can stretch anywhere from 6 up to 18 months, depending on deal size and churn risk.

Realistic examples (≤5 lines each)

B2B Data Integration Platform

- Free tier: 1M rows monthly processing limit.

- PQL trigger: Teams sync 3+ data sources with daily runs for 7 straight days.

- Sales gets strategic account PQLs within 1 hour.

- Standard PQLs just stay in the self-serve flow.

- Enterprise deals average $60k per contract.

Sales Motion Design

- Motion Fit Score: 3.6. That points to a sales-led approach, but PLG still matters.

- Enterprise customers usually want complex integrations, so they rely on sales guidance.

- Smaller teams can get by with self-serve connectors.